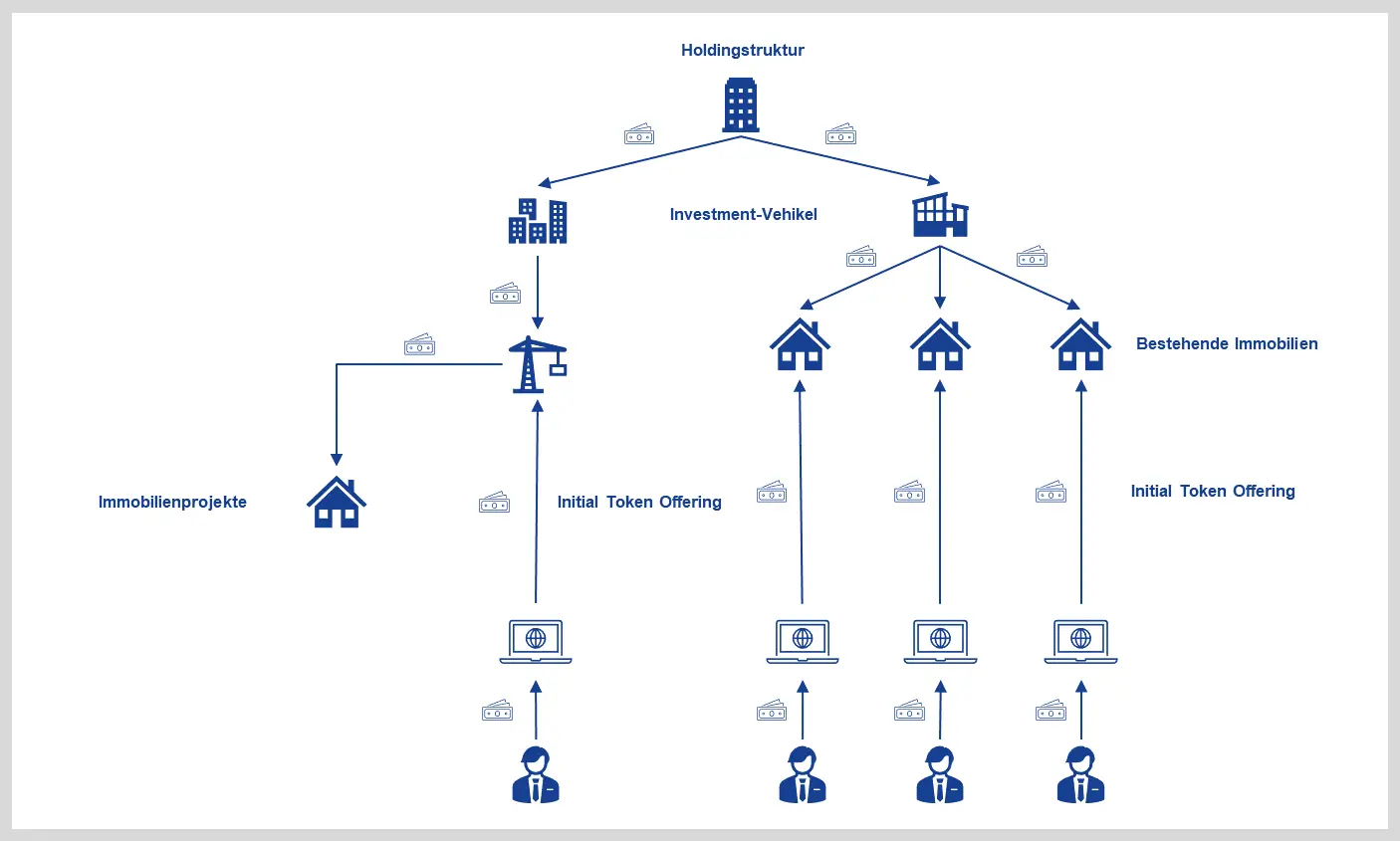

Objective: A private blockchain solution was developed for an investment fund to improve liquidity, transparency, and operational efficiency. The project focused on automating cross-departmental task management through smart contracts and tokenizing assets via Security Token Offerings (STOs) to optimize fund operations and investor engagement.

Table of contents

Key Components

-

Private Blockchain Infrastructure: A private blockchain supports secure and authorized transactions between the investment fund’s departments and stakeholders. This blockchain technology forms the foundation for tokenization, fund management, and compliance adherence, ensuring data privacy, scalability, and regulatory compliance.

-

Task Management via Smart Contracts: Internal processes were automated using smart contracts, including:

- Investor Onboarding

- KYC/AML Verification (Know Your Customer/Anti-Money Laundering)

- Reporting and Compliance Checks

- Fund Allocation Approvals

-

This automation enhanced transparency, reduced manual errors, and accelerated routine processes.

-

Asset Tokenization: Leveraging expertise in Security Token Offerings (STOs), the fund’s assets were tokenized, enabling fractional ownership of various portfolio investments, such as real estate or private debt. Token holders benefited from:

- Instant Liquidity: Day-1 liquidity through direct secondary market access.

- Fractional Ownership: Democratizing access to high-value assets through fractional ownership capabilities.

- Regulatory Compliance: Tokenization met all local and international securities and crypto-asset regulations.

-

Investor Engagement and Management: A custom platform enabled automation of KYC/AML, document management, and wallet administration, allowing accredited investors to easily participate in the digital securities offering.

-

Enhanced Transparency and Compliance: The solution provided real-time insights into fund performance and compliance adherence. Investors could monitor their holdings through a personalized dashboard, receive dividends in crypto assets or fiat, and participate in compliant secondary trading.

Results

- Operational Efficiency: Smart contract automation significantly reduced time and resource requirements.

- Enhanced Liquidity: Tokenization and secondary market access increased investor liquidity and unlocked new capital for the fund.

- Global Reach: Fractional ownership made the fund attractive to a diverse, international investor base previously excluded due to high entry barriers.

- Regulatory Compliance: The private blockchain solution and compliance framework ensured the fund met applicable security token regulations while maintaining operational transparency.