In today’s financial market, digital transformation is no longer just an option but a necessity. Banks that implement a digital platform can not only optimize their existing processes but also reach a broader user base. With a customized digital banking application, your customers – both individuals and businesses – have access to a variety of innovative features that simplify everyday banking and business operations.

Table of contents

- Mastering Challenges: From Paper to Digital Solution

- Digital Banking as the Permanent Future of Every Bank

- Benefits at a Glance

- Comprehensive Features for Maximum Efficiency

- Technical Foundations

- Benefits of Custom Applications for Banks and Fintech Companies

Mastering Challenges: From Paper to Digital Solution

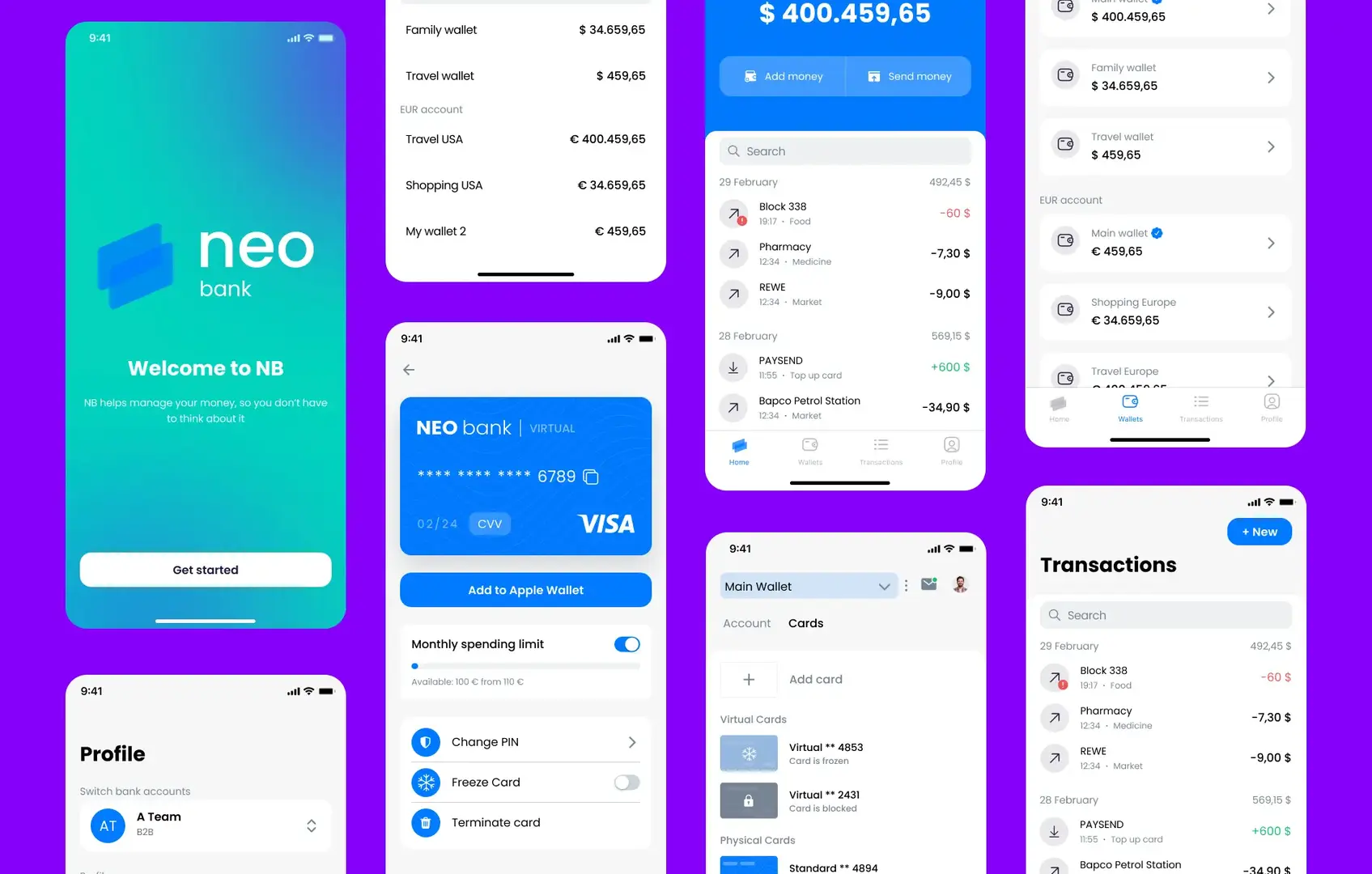

Our client, an established bank, wanted to create a modern digital platform that optimizes existing banking processes while meeting the needs of a new generation of users. The challenge was not only to develop a powerful and user-friendly application but also to seamlessly integrate existing banking systems. The app needed to be relevant for both private individuals and business customers, combining various currency and account models in one system.

Digital Banking as the Permanent Future of Every Bank

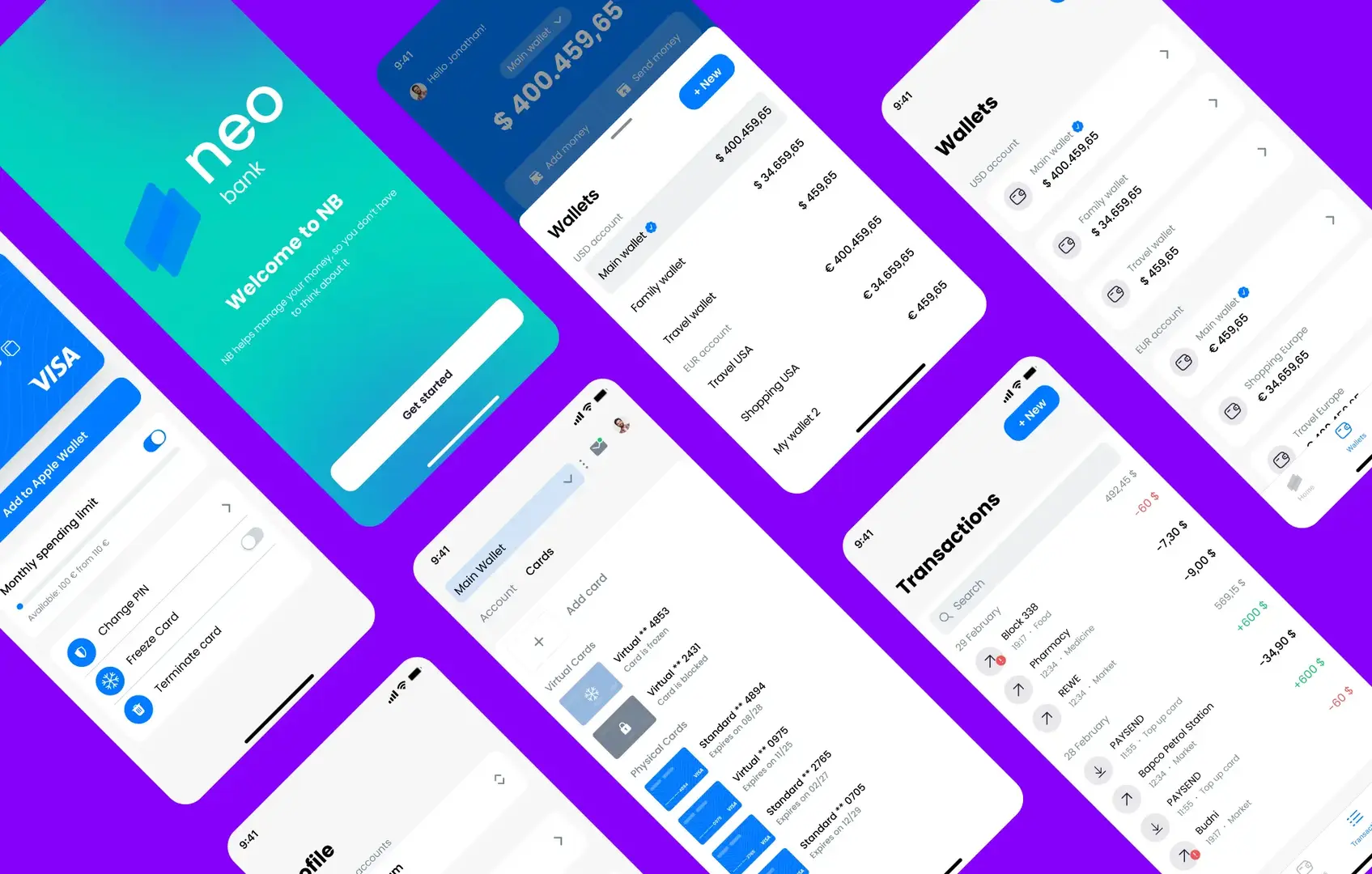

The solution we developed includes a digital platform that allows users to manage different types of accounts. A user can easily switch between private and business accounts within the app. Additionally, multiple wallets for different currencies can be maintained within each account. This flexibility provides customers with added value by allowing them to organize and manage their finances more efficiently. Another crucial advantage is real-time transfer. Customers can transfer money between accounts without delay, which is particularly advantageous in a business environment. Companies benefit from immediate payment receipts and can monitor their liquidity in real-time.

Benefits at a Glance

- Instant Account Opening: A new user can open an account in minutes – without complicated forms or long waiting times.

- Multiple Accounts and Wallets: Users can manage private and business accounts in one app, with the ability to maintain multiple currencies in parallel.

- Enhanced Security: The platform offers advanced security measures to prevent fraud and ensure data protection.

- Real Real-time Transactions: Immediate transfers in real-time enable fast and efficient payment management for both private and business customers.

Comprehensive Features for Maximum Efficiency

The digital banking solution integrates several advanced features to enable efficient management of accounts and transactions:

- Seamless Switching Between Private and Business Accounts: Customers can manage their finances on a single platform, offering benefits for both everyday life and business operations.

- Automatic Multi-Currency Management: Users have access to different wallets for various currencies, facilitating international business.

- Advanced Security Features: Pseudonymization of personal data, regular security checks, and encryption guarantee the highest level of data security.

- Real-time Transactions: Whether private or business customers – all transactions are processed in real-time, giving users immediate control over their finances.

Technical Foundations

The platform’s security and stability are ensured through state-of-the-art technologies. The backend is based on a robust architecture that is secured through regular security audits and penetration tests. Key security measures include:

- Pseudonymization of Personal Data: Sensitive data is protected by storing it only in pseudonymized form.

- Data Access Restriction: Access to data is strictly regulated based on user roles and permissions.

- Encryption and Data Protection: All communication channels and data transfers are encrypted to ensure maximum security.

Benefits of Custom Applications for Banks and Fintech Companies

Custom banking solutions offer not only an improved user experience but also enormous operational advantages. Through API integration, existing systems can be seamlessly incorporated and enhanced with new features. This adaptability is particularly crucial for banks and fintech companies that need to respond to changing market requirements.

A custom-developed digital banking solution enables banks to offer their customers a fully digital service. Thanks to the flexibility and scalability of these applications, banks can bring new products to market faster and optimize their internal processes, leading to significant cost reduction and more efficient operations.