The banking world is becoming increasingly digital. One of the biggest challenges is compliance with KYC (Know Your Customer) regulations. Previously, strict regulations required in-person customer identification. For a partner, we developed an innovative solution that has revolutionized the KYC process.

Table of contents

- The Challenge

- The Solution

- Benefits:

- Benefits for Bank and Customers

- Implementation and Results

- The results were impressive:

The Challenge

Traditional KYC processes have long required customers to appear in person at a branch to verify their identity when opening a bank account. This process was time-consuming and bureaucratic.

The Solution

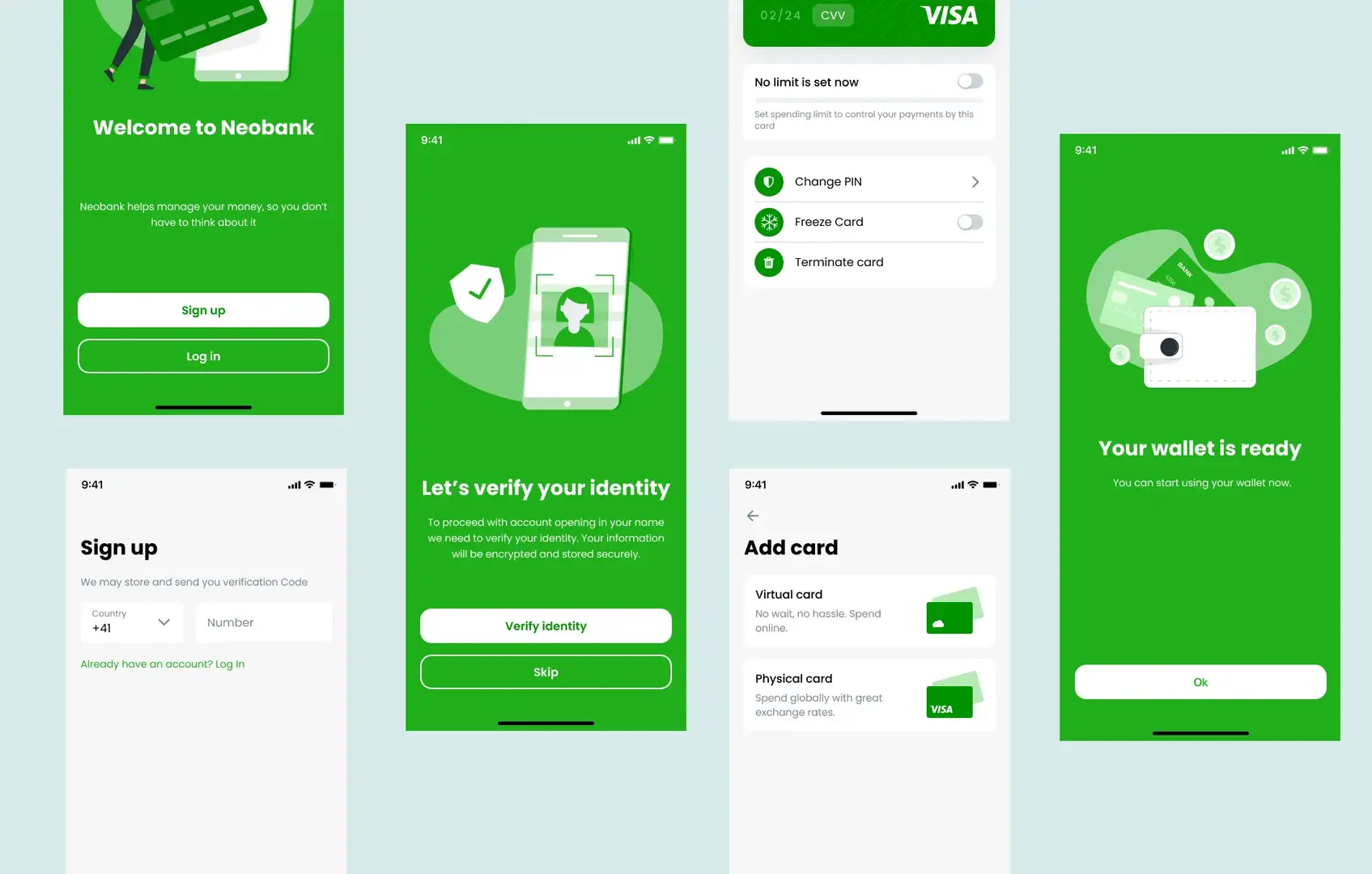

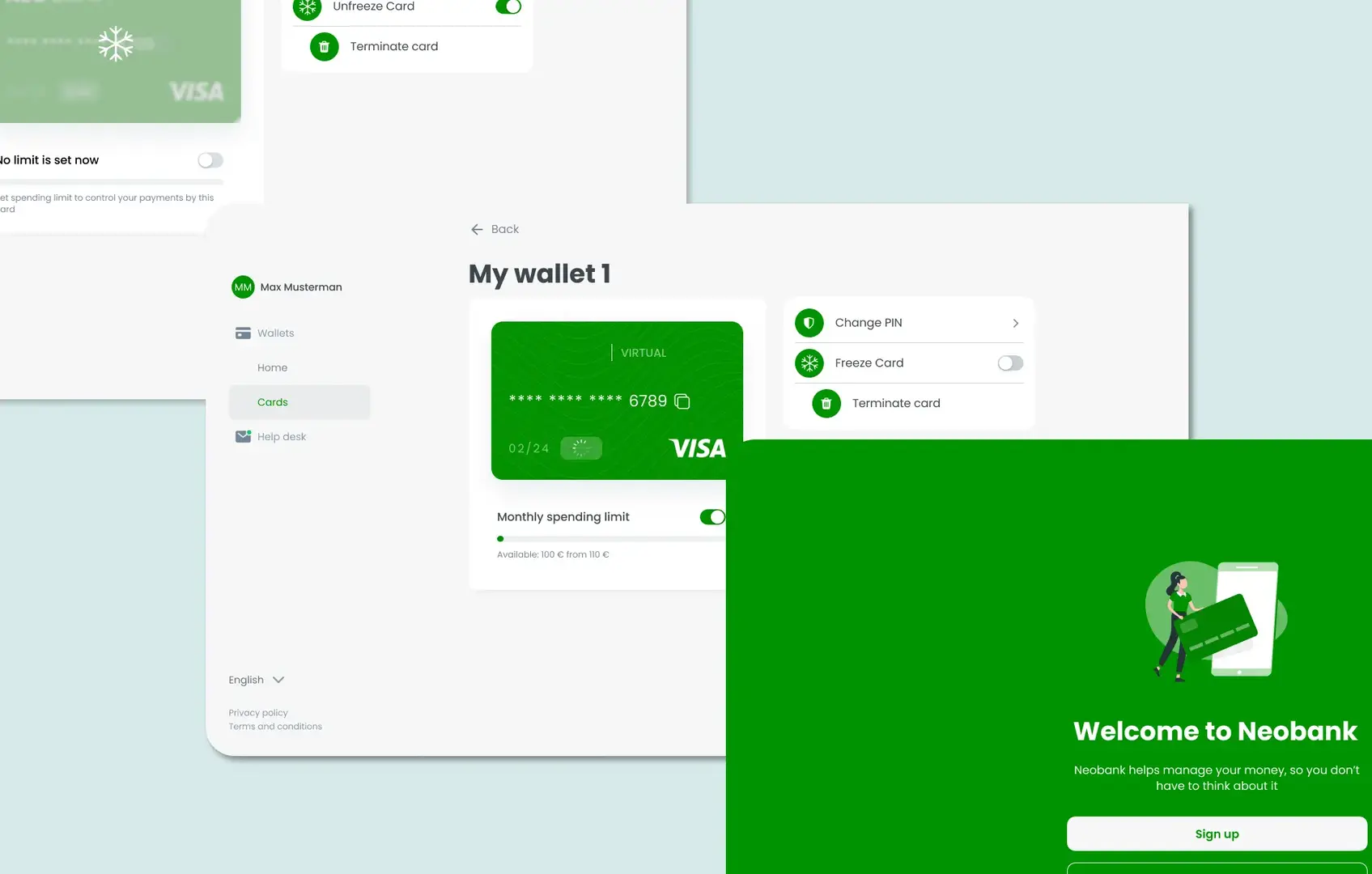

Digital KYC and comprehensive document management Thanks to a change in legislation, we were able to develop a digital KYC process that goes far beyond traditional customer identification. Our innovative process offers the following

Benefits:

- Video Identification: Customers can verify their identity conveniently from home via video chat. Biometric Data: Facial recognition technologies enable secure and fast identification.

- Electronic Signature: Documents can be signed digitally, further accelerating the process.

- Comprehensive Document Management: A centralized document service securely and efficiently manages all relevant customer documents (contracts, identification proofs, account statements, etc.).

- Seamless Integration: The document service is seamlessly integrated into all relevant processes, enabling automated processing and quick information availability.

- Data Security: All customer data is encrypted and stored according to the highest security standards.

Benefits for Bank and Customers

- Faster Account Opening: Customers can open an account within minutes.

- Increased Customer Satisfaction: A convenient and modern customer experience.

- Lower Operating Costs: Automation of routine tasks and reduction of paper usage.

- Enhanced Security: Biometric data and secure data transmission minimize fraud risk.

- Compliance: Full adherence to legal requirements.

- Efficient Document Management: All relevant documents are centrally stored and accessible at any time, increasing process efficiency.

Implementation and Results

The digital KYC process was implemented in several phases. Initially, a pilot project was launched to test the system’s functionality and security. Subsequently, the process was extended to all new customer accounts.

The results were impressive:

- Significant Processing Time Reduction: The account opening process became considerably more efficient.

- Increased Customer Retention: Customer satisfaction with the new process increased significantly.

- Efficiency Improvement: Staff can focus on more complex tasks.

The digitalization of the KYC process, combined with comprehensive document management, is a great success. Through this innovative solution, we have created a secure, efficient, and customer-friendly process. Our project demonstrates how technology can help modernize the financial industry and better meet customer requirements.