A leading insurance company faced the challenge of digitizing manual processes and increasing sales efficiency. To achieve these goals, a customized digital platform was developed that optimizes the entire insurance brokerage process. The result: significant time savings, improved communication between insurance agents, employers, and customers, as well as sustainable automation of many processes.

Table of contents

Functional Benefits for Insurance Companies

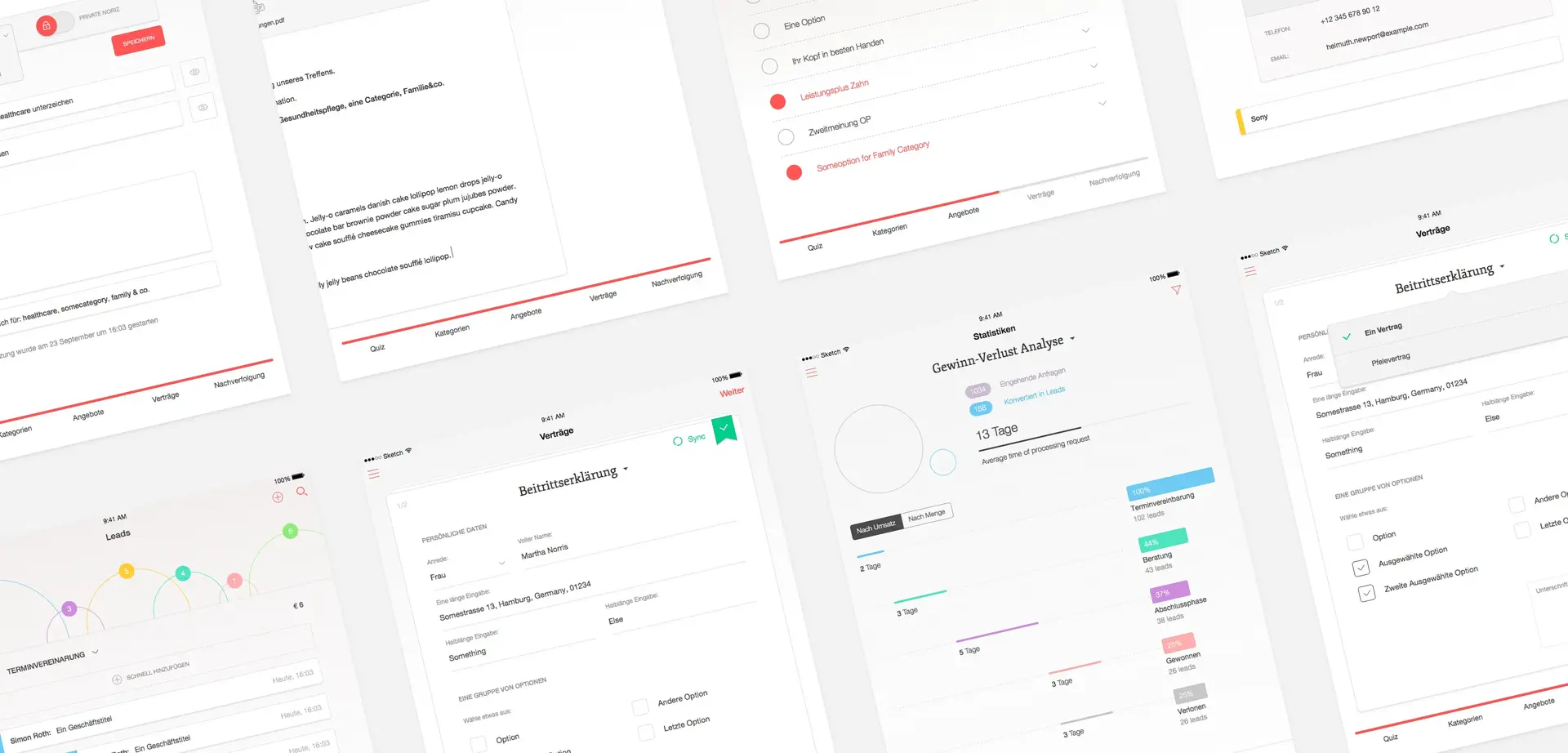

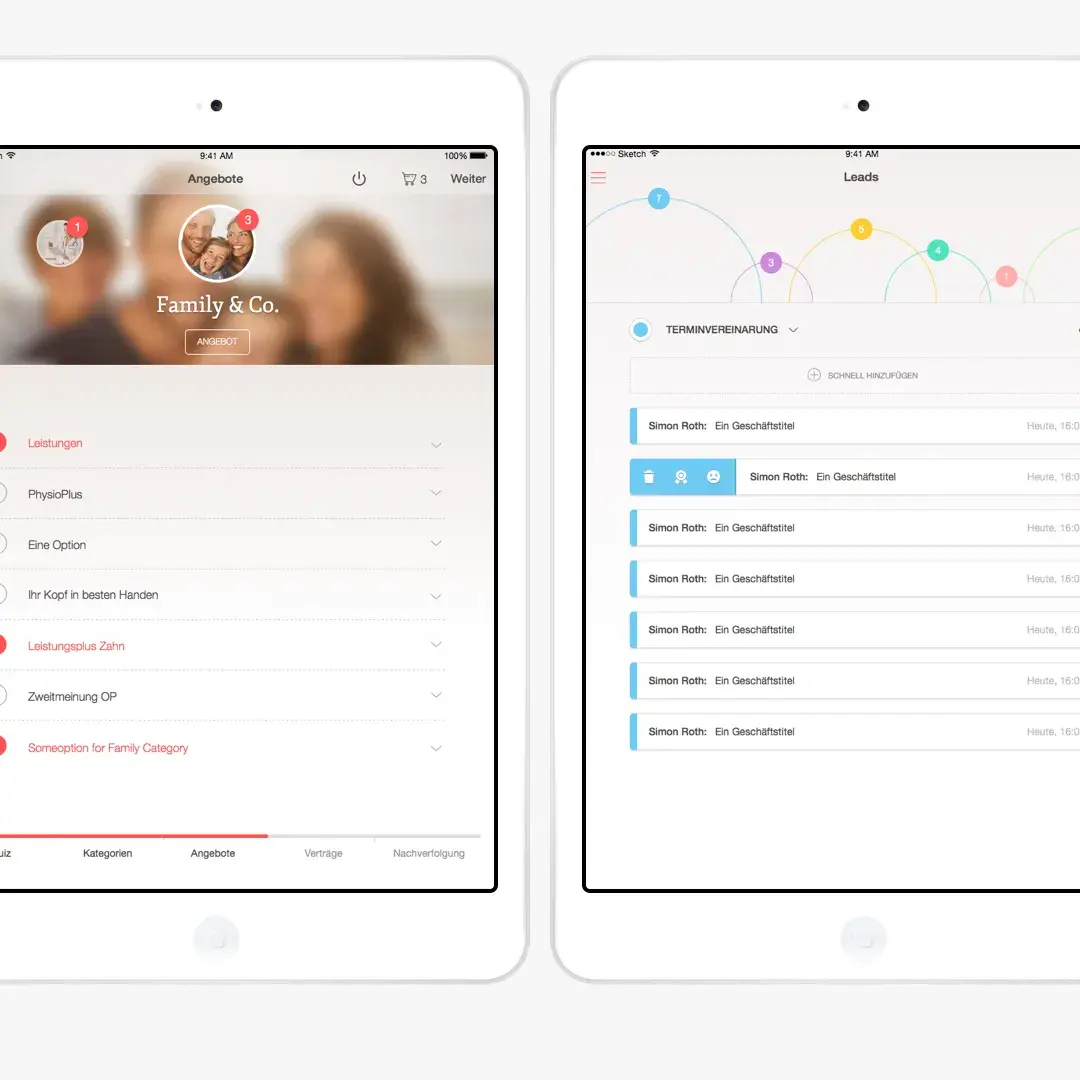

- Mobile App for Insurance Agents: Through the introduction of a mobile app for sales, insurance agents can advise their customers more efficiently. The app offers interactive consultation options where targeted questions are asked to find the optimal insurance plan. Customer data is entered directly into the system, and a digital contract conclusion is completed through an electronic signature. This feature allows contracts to be transmitted immediately to administration, significantly accelerating the process.

- Integration with HR Systems: The platform was designed to work seamlessly with the HR systems of companies offering insurance to their employees. This allows new employees to be quickly and easily added to the insurance database as their information is automatically transferred. Changes in personnel, such as employee entries or exits, are directly updated in the platform, minimizing manual effort for the insurance company and reducing error rates.

- CRM for Comprehensive Customer Care: A CRM system specifically tailored to the needs of the insurance industry offers insurance companies the ability to centrally manage all customer data. This includes information on concluded contracts, customer interactions, and historical insurance data. Sales can thus manage all sales processes more efficiently, prioritize tasks, and implement targeted measures for customer retention. Additionally, the CRM system enables transparent tracking and provides data-based insights that support efficiency enhancement in sales.

Digitalization Results for the Client

Through the implementation of this digital platform, significant improvements were achieved for the insurance company:

- Efficient Customer Consultation: Agents can advise their customers faster and more precisely as they have access to comprehensive data and are supported by automated consulting tools.

- Faster Contract Conclusions: Digital contract signing and immediate transmission to administration has drastically reduced the time required for concluding and processing contracts.

- Automated HR Processes: Connection to customer companies’ HR systems allows the insurance company to automatically manage employee data and efficiently adjust insurance contracts.

- Security and Compliance: State-of-the-art cybersecurity technologies guarantee secure storage and processing of sensitive customer data, fully meeting data protection and compliance requirements.

The digital platform brought noticeable process optimization for the insurance company. Through the automation of routine tasks, seamless integration into existing systems, and the introduction of mobile solutions, sales, administration, and customer service were elevated to a new level of efficiency. The insurance company now benefits from increased flexibility, improved customer retention, and a long-term cost-efficient way of working.