In an era where digitalization and payment security play a crucial role, banks and payment service providers need innovative solutions to meet the requirements for efficiency, transparency, and fraud prevention. Checkpayee, a MEDIASAPIENS product, elevates the concept of Verification of Payee (VOP) to a new level and provides a robust platform for account verification within the SEPA standard. Thanks to a fully automated solution specifically developed for banks and payment service providers, Checkpayee combines maximum payment security with easy integration and regulatory compliance.

Table of contents

- What is Verification of Payee (VOP)?

- Key Features of Checkpayee:

- Why Banks Need Checkpayee:

- Certifications and Memberships

- Future Perspectives for Checkpayee and VOP

What is Verification of Payee (VOP)?

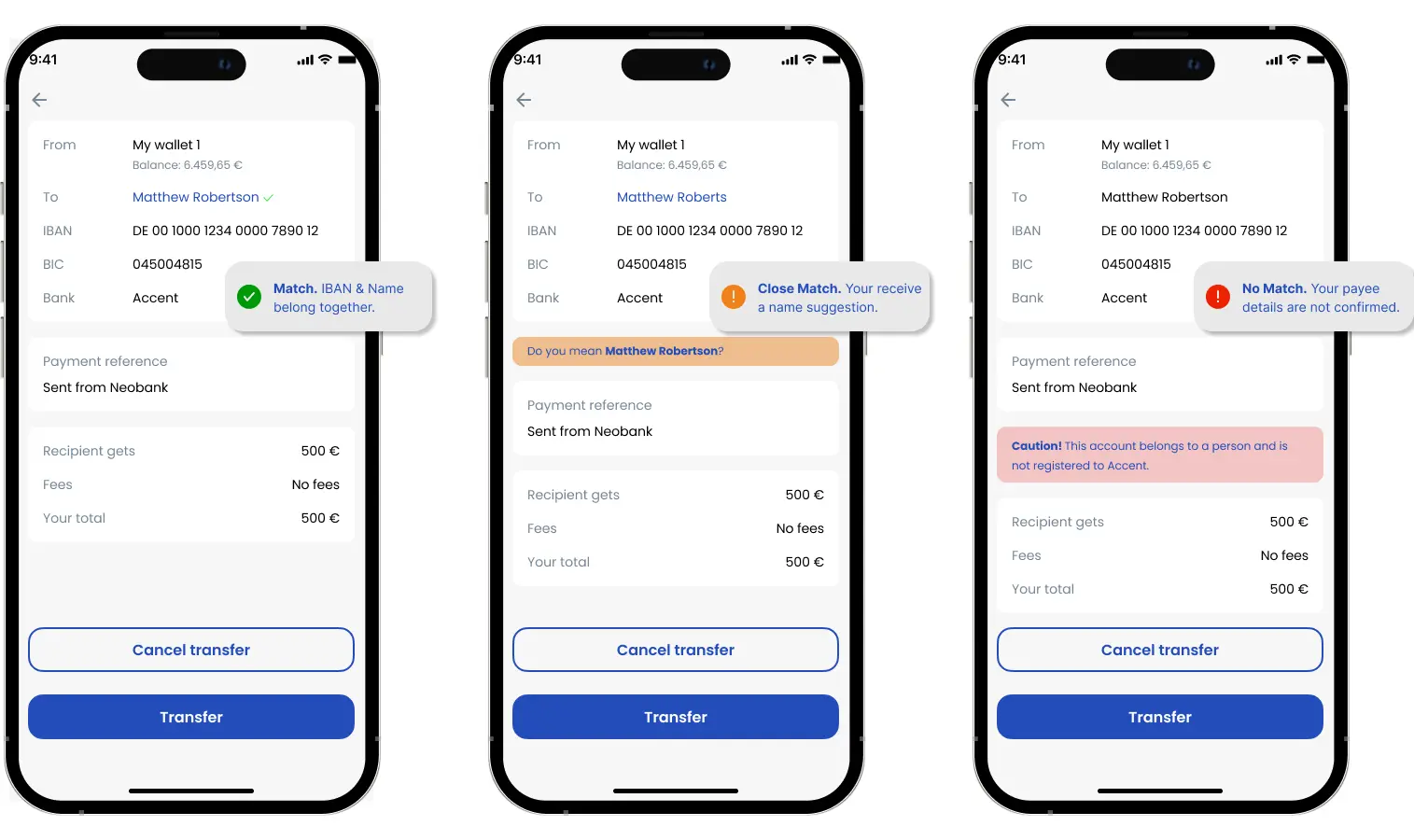

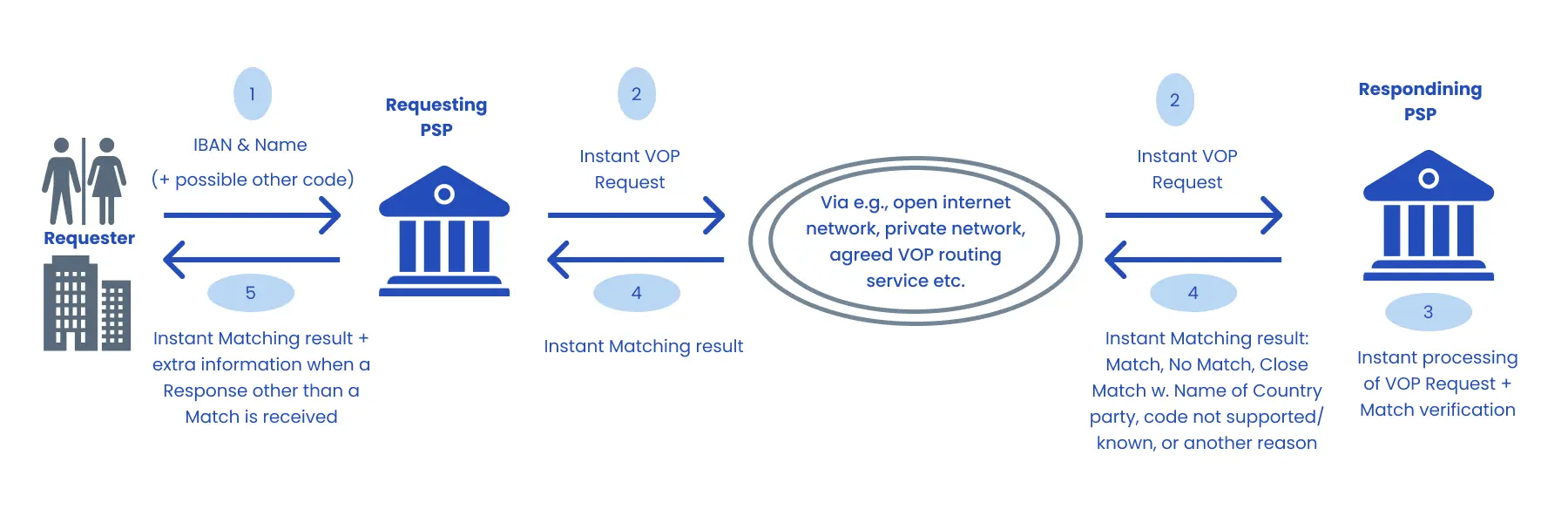

Verification of Payee enables banks and payment service providers to verify the match between IBAN and payee name before executing a payment. The goal is to avoid incorrect transfers, prevent fraud, and strengthen end-user trust. This is particularly important in the SEPA area, where instant payments are increasingly being used. Checkpayee was developed to meet these requirements by providing banks with a reliable and standardized method for account verification.

Key Features of Checkpayee:

1. Advanced Account Verification Functions:

- Verification of IBAN and name or alternative identifiers such as VAT ID or LEI (Legal Entity Identifier).

- Support for “Exact Match”, “Close Match”, and “No Match” to ensure maximum flexibility and precision.

2. Seamless Integration through API:

- Standardized API interface enabling easy integration into existing payment processes.

- Compatibility with state-of-the-art security standards such as QWAC and TLS.

3. Security and Speed:

- Fully automatic verification with response time under 5 seconds, ideal for instant payments.

- Protection of sensitive data through encrypted communication and strong authentication.

4. Regulatory Compliance:

- Full compliance with EPC guidelines and PSD2 requirements.

- Certification according to ETSI TS 119 495 for highest trustworthiness.

5. Scalability:

- Suitable for banks of any size, from small institutions to large networks with complex requirements.

Why Banks Need Checkpayee:

The requirements for Regulatory Compliance and Secure Payment Processing continue to increase. Incorrect or fraudulent payments can not only diminish customer trust but also cause significant financial losses.

With Checkpayee, banks and payment service providers can:

- Reduce Fraud: By preventing payments to unauthorized recipients.

- Lower Costs: Automated processes minimize effort and error rates.

- Increase Customer Satisfaction: Transparent and secure payments build trust.

- Ensure Regulatory Compliance: Adherence to standards such as PSD2 and EPC frameworks.

Certifications and Memberships

Checkpayee is not only fully compatible with SEPA standards but has also been certified according to the highest security standards:

- QWAC certificates ensure secure authentication.

- Inclusion in the EPC Directory Service (EDS) to ensure adherence and reachability in the VOP scheme.

Future Perspectives for Checkpayee and VOP

As real-time payment systems continue to expand throughout the SEPA region, the importance of Verification of Payee will continue to grow. Checkpayee ensures that banks and payment service providers are well-positioned to master future challenges and design payment processes efficiently and securely.

With Checkpayee, MEDIASAPIENS offers a solution that not only meets current requirements but enables banks and payment service providers to assert themselves in the dynamic payment processing market. Verification of Payee is more than just a security mechanism – it’s an indispensable component of modern financial technology.

Contact us today to learn how Checkpayee can improve your payment security! Visit verification-of-payee.com for more information.